In India, salaried individuals can claim various deductions under the Income Tax Act to reduce their taxable income. Here are some common deductions available to salaried persons in India:

Standard Deduction:

A standard deduction of Rs. 50,000 is available for salaried individuals from their gross salary income.

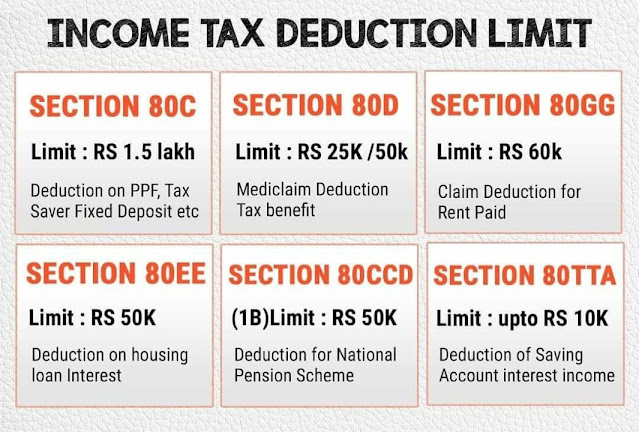

Section 80C:

Deductions under Section 80C can be claimed for investments made in various instruments such as Employee Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Scheme (ELSS), Sukanya Samriddhi Yojana, Tax-saving Fixed Deposits, etc. The maximum limit under Section 80C is Rs. 1.5 lakhs.

Home Loan Interest:

Deduction for interest on home loan under Section 24(b) of the Income Tax Act. This deduction is subject to a maximum limit of Rs. 2 lakhs for self-occupied properties.

Health Insurance Premium:

Deduction under Section 80D for health insurance premium paid for self, spouse, children, and parents. The maximum deduction limit varies depending on the age of the insured individuals and the type of coverage.

Education Loan Interest:

Deduction under Section 80E for interest paid on education loan for higher studies.

Medical Expenses for Disabled Dependent:

Deduction under Section 80DD for medical expenses incurred for the treatment of a disabled dependent.

Donations to Charitable Institutions:

Deduction under Section 80G for donations made to eligible charitable institutions.

House Rent Allowance (HRA):

If HRA is part of the salary and the individual pays rent for accommodation, they can claim deduction under Section 10(13A).

Interest on Savings Account:

Deduction up to Rs. 10,000 on interest earned from savings account under Section 80TTA.

Transport Allowance:

Deduction for transport allowance up to Rs. 1,600 per month under Section 10(14) of the Income Tax Act.

Medical Expenses:

Reimbursement of medical expenses incurred by the employee for self or family can be exempted from tax to a certain limit.

It's important to note that the eligibility and limits for deductions may change from year to year based on amendments to the Income Tax Act. Taxpayers are advised to consult a tax professional or refer to the latest tax laws for accurate information